Attention All Non-U.S. Business Owners…

Access 6 Figure 0% Credit Lines &

95% Off 5-Star Travel

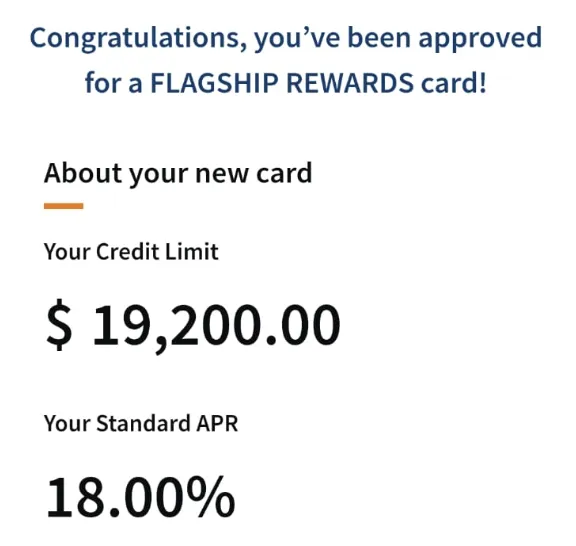

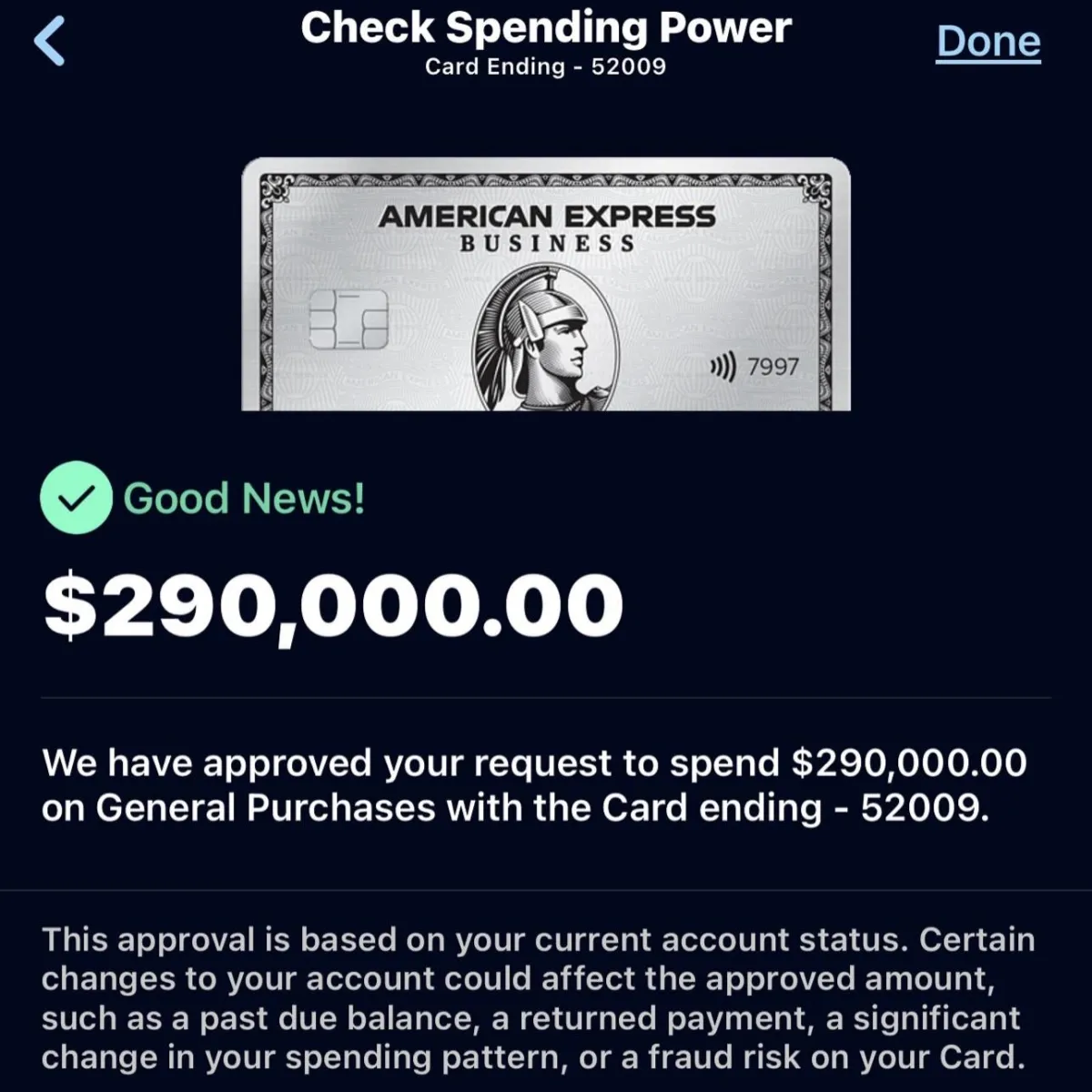

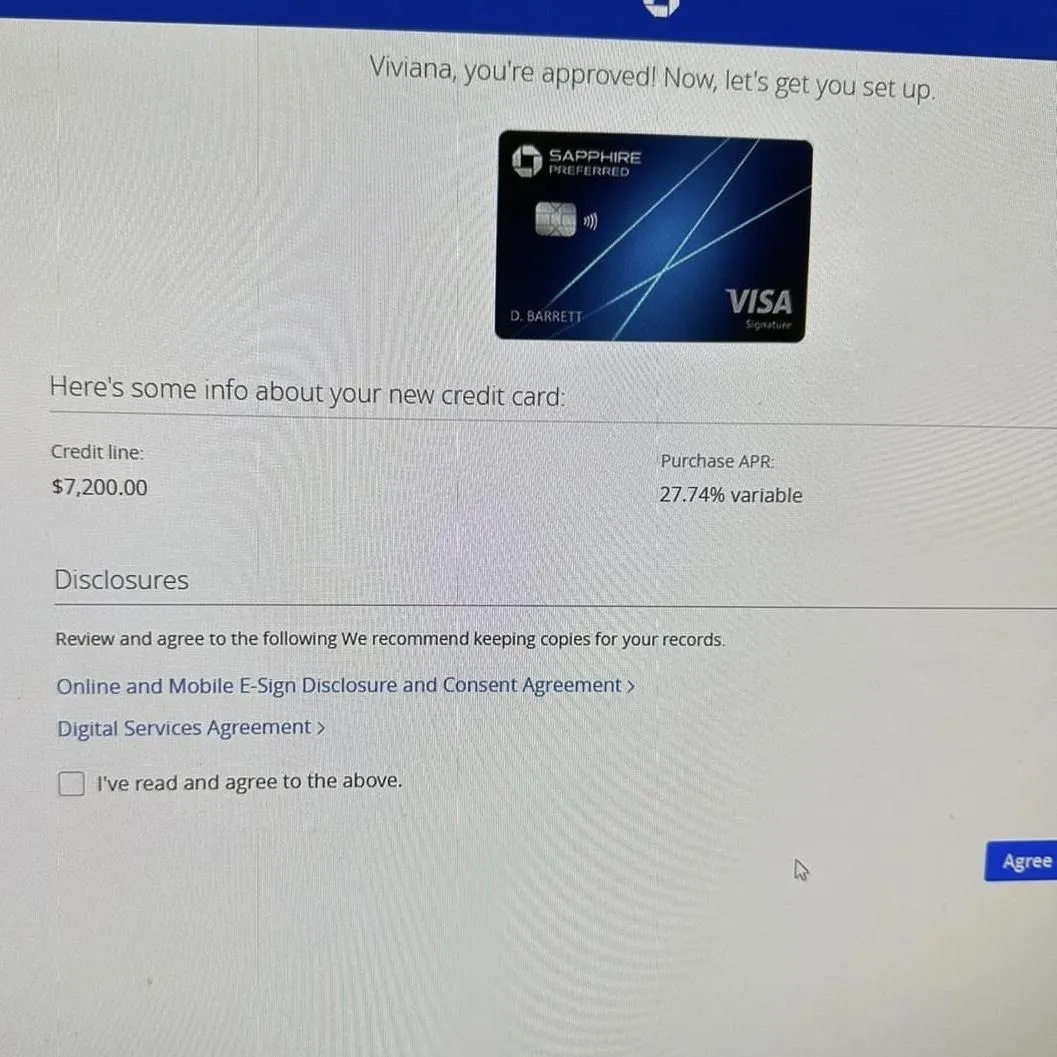

Unlocks access to the Premier US Banks for 6 figure 0% interest funding and Turns Business Spend into 4x points for Luxury Travel, saving up to 95% on Five-Star Travel.

Attention All Non-U.S. Business Owners…

Access 6 Figure 0% Credit Lines &

95% Off 5-Star Travel

Unlocks access to the Premier US Banks for 6 figure 0% interest funding and Turns Business Spend into 4x points for Luxury Travel, saving up to 95% on Five-Star Travel.

500+ ITIN's Processed and $4.3 Million in Funding Delivered to Non-US Clients

500+ ITIN's Processed and $4.3 Million in Funding Delivered to Non-US Clients

Think getting U.S. credit as a non-U.S. resident is impossible?

The financial system wants you to believe that. See...

While other non-U.S. business owners hit dead ends with “residency required", rejections our team has helped over 500+ international entrepreneurs unlock over $4.3 million dollars without relocating to America.

We’re not your typical financial consultants…

We're the team that has proven experience, proven banking connections, proven systems to get into the U.S. financial system legally.

While your competitors stay locked out…

We’ve turned the “impossible” to inevitable.

Think getting U.S. credit as a non-U.S. resident is impossible?

The financial system wants you to believe that. See...

While other non-U.S. business owners hit dead ends with “residency required", rejections our team has helped over 500+ international entrepreneurs unlock over $4.3 million dollars without relocating to America.

We’re not your typical financial consultants…

We're the team that has proven experience, proven banking connections, proven systems to get into the U.S. financial system legally.

While your competitors stay locked out…

We’ve turned the “impossible” to inevitable.

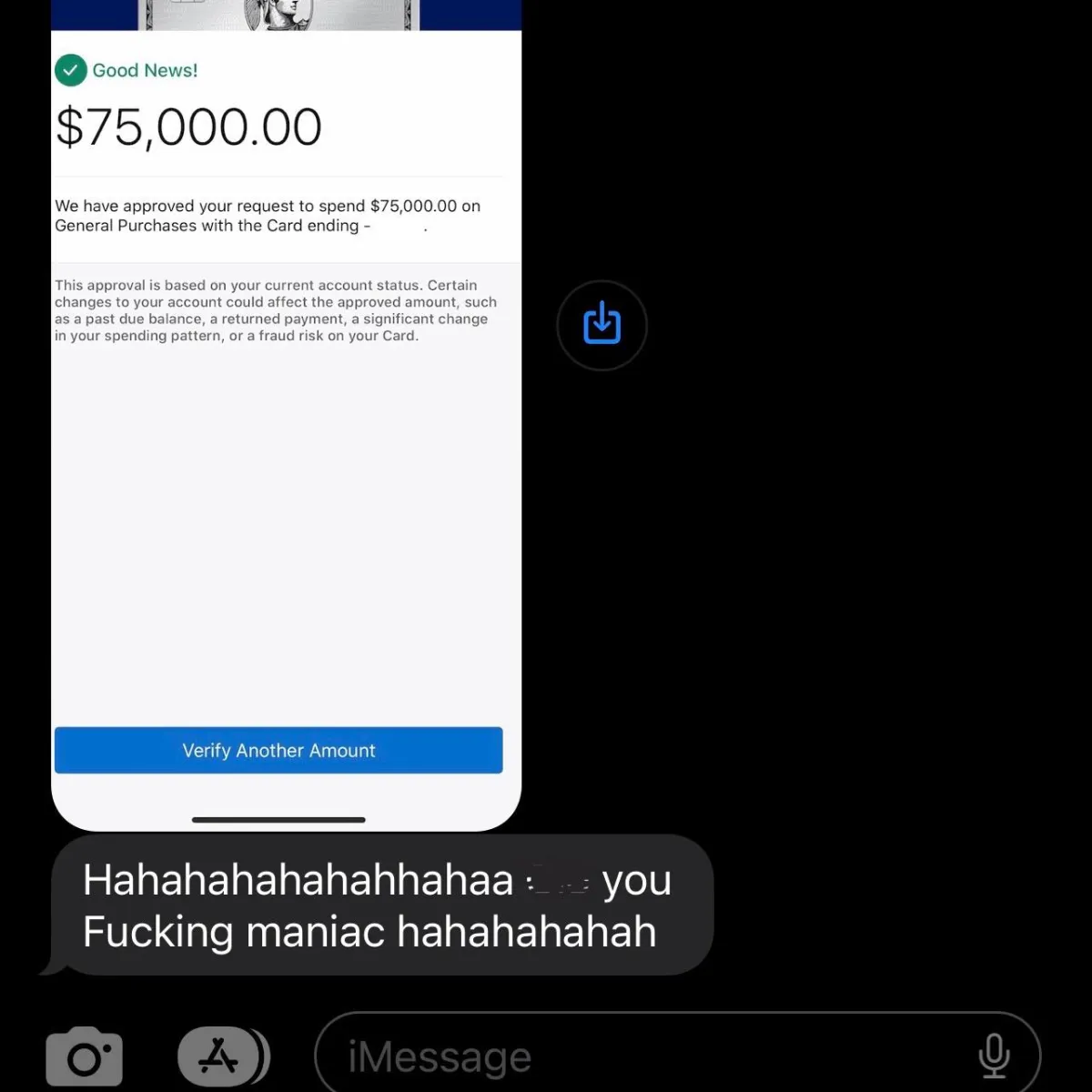

Browse through Our Client Results

At UP Credit, we Pride Ourselves on our 97.3% Client Satisfaction Rates.

GOT AMERICAN CREDIT IN LESS THAN TWO MONTHS

"Very professional team, they walked me through the whole entire process step by step. Without Team UP credit I don't know where I would be.""

GOT AMERICAN CREDIT IN LESS THAN TWO MONTHS

"Very professional team, they walked me through the whole entire process step by step. Without Team UP credit I don't know where I would be.""

Yes we have even more Client Results!

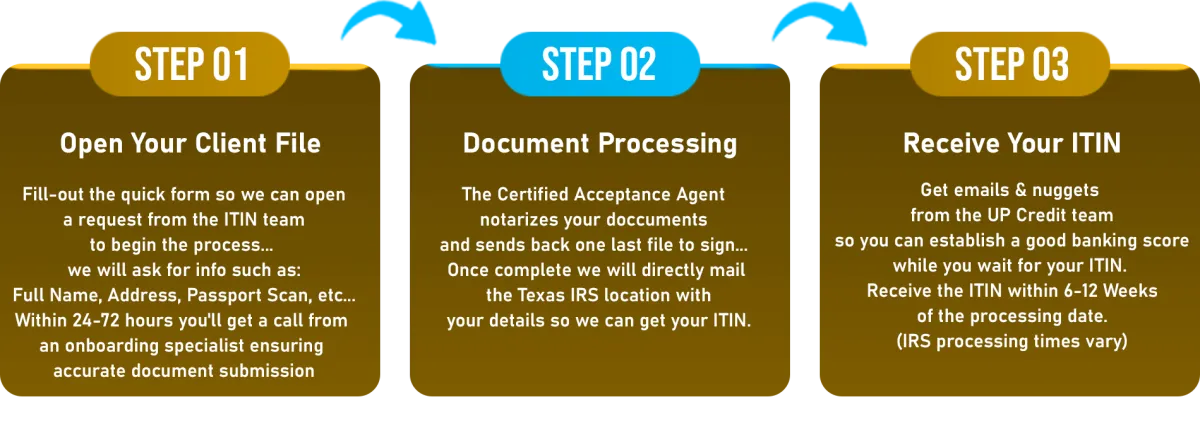

Ready To Take the First Step?

Get Your ITIN First.

Here’s the truth most “gurus” won’t tell you: You can't access real American credit without an ITIN.

Think of your ITIN like a master key. Without it, every bank door stays locked. With it, you’re suddenly speaking the same language as the American financial system.

Most non-U.S. business owners believe they need a Social Security Number to access American credit. Complete nonsense.

Your ITIN allows you to take advantage of the American financial system without stepping foot in America or changing your citizenship.

Get your ITIN in as little as 12 weeks - completely handled by our IRS-certified team. No complicated paper work. No travel required.

Once your ITIN is in hand, getting access to American credit cards becomes the easy part.

Already have an ITIN? (Keep Scrolling)

Frequently Asked Questions

Everything you need to know about UP Credit

Is it legal for non-U.S. citizens to access American credit?

Yes. It is completely legal for non-U.S. citizens to access U.S. credit as long as the proper process is followed. U.S. banks and credit issuers welcome international business owners.

Do I need to live in the U.S. to qualify?

No. Many of our clients live outside the U.S. and still access the same financial tools as American citizens. Location is not a barrier if you follow the right steps.

Do I need to pay U.S. taxes?

Not necessarily. Having U.S. credit cards does not automatically mean you owe U.S. taxes. Tax responsibility depends on your business structure and residency, but most non-U.S. clients do not pay U.S. taxes.

How long does it take to get results?

Timelines vary based on your starting point and goals. On average, clients begin accessing premium U.S. credit cards within 6–10 months, and many secure six-figure funding within the first year.

Do I need to travel to the U.S.?

Travel is optional but recommended for higher-level funding. Some services can be done remotely, but one in-person trip often helps establish a stronger foundation.

What is UP Credit Platinum?

UpCredit Platinum is our premium program for serious entrepreneurs. It combines advanced credit strategies, travel hacking, and access to our network of non-U.S. business owners using U.S. credit.

What are your offers?

We provide three main types of services: DIY (do-it-yourself programs), Done-With-You (guided support), and Done-For-You (hands-on execution). The best fit depends on your goals and business needs.

What do you help non-U.S. business owners achieve?

We help entrepreneurs unlock U.S. credit to scale their businesses and maximize rewards from their spending. The goal is access to capital, improved cash flow, and travel or lifestyle benefits.

What are the minimum requirements to qualify?

Most clients spend at least $10K per month on their business or generate $20K+ in revenue. Around $20K in available capital is also recommended to boost approval odds.

Do I need an existing U.S. LLC or business entity before working with you?

No. You can start without an LLC, and we’ll guide you through forming one if needed. Many clients already have entities, but it’s not required.

How is my personal information protected?

Your data is never shared outside our company. We maintain strict internal security policies and full privacy compliance, detailed in our legal policies at the bottom of the site.

How do you support clients in the process?

Support is delivered through one-on-one guidance, group resources, and dedicated communication channels. Depending on your program, this may include Slack, phone, WhatsApp, and our private Skool community.

Frequently Asked Questions

Everything you need to know about UP Credit

Is it legal for non-U.S. citizens to access American credit?

Yes. It is completely legal for non-U.S. citizens to access U.S. credit as long as the proper process is followed. U.S. banks and credit issuers welcome international business owners.

Do I need to live in the U.S. to qualify?

No. Many of our clients live outside the U.S. and still access the same financial tools as American citizens. Location is not a barrier if you follow the right steps.

Do I need to pay U.S. taxes?

Not necessarily. Having U.S. credit cards does not automatically mean you owe U.S. taxes. Tax responsibility depends on your business structure and residency, but most non-U.S. clients do not pay U.S. taxes.

How long does it take to get results?

Timelines vary based on your starting point and goals. On average, clients begin accessing premium U.S. credit cards within 6–10 months, and many secure six-figure funding within the first year.

Do I need to travel to the U.S.?

Travel is optional but recommended for higher-level funding. Some services can be done remotely, but one in-person trip often helps establish a stronger foundation.

What is UP Credit Platinum?

UpCredit Platinum is our premium program for serious entrepreneurs. It combines advanced credit strategies, travel hacking, and access to our network of non-U.S. business owners using U.S. credit.

What are your offers?

We provide three main types of services: DIY (do-it-yourself programs), Done-With-You (guided support), and Done-For-You (hands-on execution). The best fit depends on your goals and business needs.

What do you help non-U.S. business owners achieve?

We help entrepreneurs unlock U.S. credit to scale their businesses and maximize rewards from their spending. The goal is access to capital, improved cash flow, and travel or lifestyle benefits.

What are the minimum requirements to qualify?

Most clients spend at least $10K per month on their business or generate $20K+ in revenue. Around $20K in available capital is also recommended to boost approval odds.

Do I need an existing U.S. LLC or business entity before working with you?

No. You can start without an LLC, and we’ll guide you through forming one if needed. Many clients already have entities, but it’s not required.

How is my personal information protected?

Your data is never shared outside our company. We maintain strict internal security policies and full privacy compliance, detailed in our legal policies at the bottom of the site.

How does UP Credit support clients through the process?

Support is delivered through one-on-one guidance, group resources, and dedicated communication channels. Depending on your program, this may include Slack, phone, WhatsApp, and our private Skool community.

Access Premier US Fianancial Products

UP Credit has Established Relationships With 500+ Banks, Lenders & Issuers in America

Unlocks access to the Premier US Banks for 6 figure 0% interest funding and Turns Business Spend into 4x points for Luxury Travel, saving up to 95% on Five-Star Travel.

Click to Apply for a call with a Credit Specialist. (15 Min)

Your Specialist will go over how you can take advantage of this system yourself and how the process looks like.

Need help? Contact us at [email protected] or +1-786-628-7370

Privacy and Policy | Terms of Use I Fulfillment Policy I Cancellation Policy

© 2025 Peak State Consulting LLC | Empowering Entrepreneurs with Capital Access

Disclaimer: This site is not a part of the Facebook™ website or Facebook Inc.

Additionally, this site is NOT endorsed by Facebook™ in any way. FACEBOOK™ is a trademark of FACEBOOK, Inc.

American Credit Calculator is for educational and entertainment use only. Points, rewards, and funding figures are estimates based on past client outcomes, not predictions or guarantees for you. This is not financial, legal, or tax advice. Verify independently. UP Credit assume no liability.